Negotiable

Elevate Your Banking Experience with Absa South Africa

- Category: Online Services

- Sub Category: Other Online Services

- Location: Springs, Gauteng

- Ad Posted: 5 months ago

- Website: https://www.absa.co.za/personal/

Descirption

Absa South Africa is at the forefront of the banking industry, offering comprehensive services tailored to individuals and businesses alike. Whether you're managing personal finances, running a business, or exploring digital banking solutions, Absa is the trusted partner for all your financial needs. Their commitment to innovation and customer satisfaction ensures that Absa remains a leading bank in South Africa.

What Makes Absa a Leader Among Banks?

Absa, a renowned financial institution, offers a wide array of services designed to simplify banking for its customers. From opening a bank account to using Absa Online Banking, every service is seamlessly designed to cater to the evolving needs of modern-day banking. Whether you are new to banking or a seasoned user, Absa's solutions make it easy for you to stay in control of your finances.

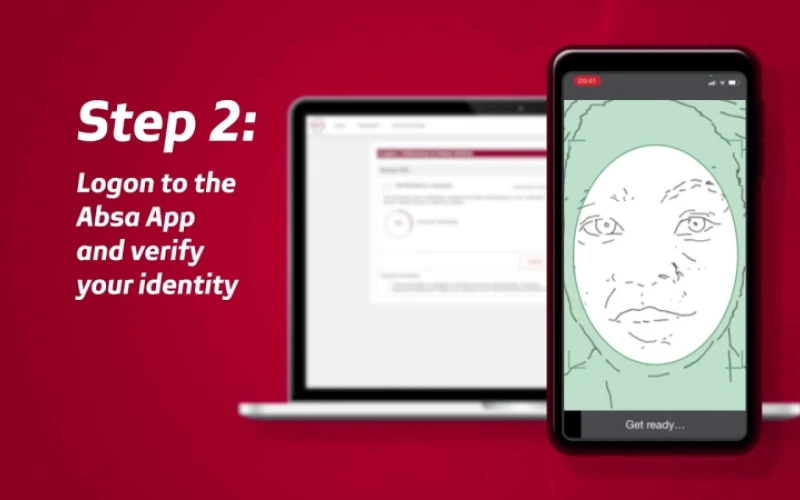

Digital Banking with Absa

Absa Online Banking is a standout feature, offering secure and convenient access to your accounts anytime, anywhere. With advanced security measures, Absa ensures your personal and financial data are protected at all times. The platform allows you to check balances, make payments, and manage accounts with just a few clicks.

The Absa Banking App further elevates the experience, bringing convenience to your fingertips. Rated as one of the best banking apps in South Africa, it allows users to bank effortlessly on the go. You can transfer funds, pay bills, and even track expenses—all with a few taps on your smartphone.

People Also Ask

How Do I Open a Bank Account with Absa?

Opening a bank account with Absa is a straightforward process. Whether you're looking for a savings account, a cheque account, or a business account, Absa provides a range of options to meet your needs.

To open an account:

Visit www.absa.co.za and navigate to the "Open an Account" section.

Choose the type of account that suits your requirements.

Complete the online application form and upload your supporting documents, such as your ID and proof of residence.

Once your application is processed, you will receive confirmation and details of your new account.

For those who prefer in-person assistance, you can visit any Absa branch, where friendly staff will guide you through the process.

Is Absa Bank Online?

Yes, Absa Bank offers comprehensive online banking services, making it easy for customers to manage their finances from anywhere. Absa Online Banking allows you to:

Check account balances.

Transfer money between accounts.

Pay bills securely.

Purchase prepaid services like airtime and electricity.

Absa's digital platform is designed with user-friendliness and security in mind, ensuring a hassle-free experience. Whether on your desktop or mobile device, Absa's online banking services are accessible 24/7.

What Services Does Absa Bank Offer?

Absa South Africa provides a wide range of services to meet diverse financial needs. Key offerings include:

Personal Banking: Savings accounts, loans, credit cards, and more.

Business Banking: Solutions for SMEs and large corporations, including business accounts and merchant services.

Digital Banking: Absa Online Banking and the Absa Banking App for convenient, secure transactions.

Investment Services: Grow your wealth with tailored investment options.

Insurance Products: Protect your assets with comprehensive insurance plans.

Absa also facilitates access to lottery services such as Lotto and Powerball, allowing customers to purchase tickets directly through their platform.

What Is the Phone Number for Absa Online Banking?

For assistance with Absa Online Banking, you can contact their dedicated support team at 0860 111 515. Whether you need help registering, resetting your password, or troubleshooting issues, the team is available to provide prompt and professional support.

Alternatively, you can email Absa at absa@absa.co.za or visit the help section on their website for detailed guides and FAQs.

The Advantages of Using Absa Online Banking

Absa Online Banking offers numerous benefits, including:

Convenience: Access your accounts from anywhere in the world.

Security: Advanced measures to protect your information.

Efficiency: Manage your finances quickly and easily without visiting a branch.

Comprehensive Services: From bill payments to fund transfers, everything is just a click away.

By combining robust technology with customer-centric features, Absa ensures a seamless banking experience for its users.

Explore the Absa Banking App

The Absa Banking App is a game-changer in the world of digital banking. Rated highly by users on platforms like the Apple App Store and Google Play, the app provides a secure, fast, and convenient way to manage your finances.

Key features of the app include:

Instant Fund Transfers: Move money between your accounts or send money to others.

Bill Payments: Pay utility bills, school fees, and more with ease.

Budget Tracking: Monitor your spending and manage budgets effectively.

Lotto and Powerball: Purchase tickets for a chance to win big.

With regular updates and enhancements, the Absa Banking App continues to set new benchmarks in digital banking.

Conclusion

Absa South Africa is more than just a bank; it is a partner in your financial journey. Whether you're using Absa Online Banking, exploring the Absa Banking App, or visiting one of their branches, you can expect world-class service and innovative solutions.

With a commitment to excellence and a focus on customer satisfaction, Absa remains a top choice among banks in South Africa. Visit www.absa.co.za today to discover how Absa can transform your banking experience.