Negotiable

Capitec Bank: Simplified Personal and Business Banking

- Category: Online Services

- Sub Category: Other Online Services

- Location: Lydenburg, Gauteng

- Ad Posted: 1 day ago

- Website: https://www.capitecbank.co.za/

Descirption

Capitec Bank is one of South Africa’s leading financial institutions, known for its innovative and customer-centric approach. Whether you're seeking affordable transactions, credit solutions, or insurance, Capitec Bank has tailored products to simplify banking for everyone. With a wide range of services and digital tools like the Capitec mobile application, customers can access secure and convenient banking anytime, anywhere. Let’s dive into everything Capitec offers, from Capitec branch codes to opening an account online.

The Convenience of the Capitec Mobile Application

The Capitec mobile application is a game-changer for those who value convenience and efficiency. With this app, users can access their accounts, make payments, buy airtime, and even apply for loans. The Capitec application allows real-time transactions with an intuitive interface designed to make digital banking effortless. Whether you’re at home or on the go, the Capitec mobile application ensures that your financial needs are just a tap away.

Understanding Capitec Branch Codes

Each Capitec branch code is unique, making transactions easy to track. These codes simplify banking processes, whether you’re making payments, transfers, or deposits. To find the branch code for Capitec, you can check the official website or visit any branch. Having the correct Capitec branch codes ensures smooth and secure banking transactions.

Capitec’s Digital Transformation

Capitec Bank stands out for its seamless integration of digital banking services. The Capitec mobile application plays a significant role in this transformation, offering customers access to a wide range of features, from viewing account balances to managing multiple accounts. The app is highly secure, ensuring that users' financial information remains protected.

Why Choose Capitec?

Capitec Bank prioritizes simplicity and transparency, offering services that cater to both personal and business banking needs. Whether you’re opening an account or using the Capitec mobile application, you’ll experience efficient, user-friendly solutions. With a strong presence through its Capitec branches and comprehensive Capitec branch codes, the bank ensures that every customer has access to reliable and secure banking.

What People Ask About Capitec Bank

1. How do I send my CV to Capitec Bank via email in South Africa?

To apply for a position at Capitec Bank, you can visit the Capitec careers page on their official website. Create an account, upload your CV, and follow the instructions to complete your application. Alternatively, you can send your CV via email to their HR department using the address provided on their careers page. Capitec often looks for motivated individuals passionate about delivering exceptional service.

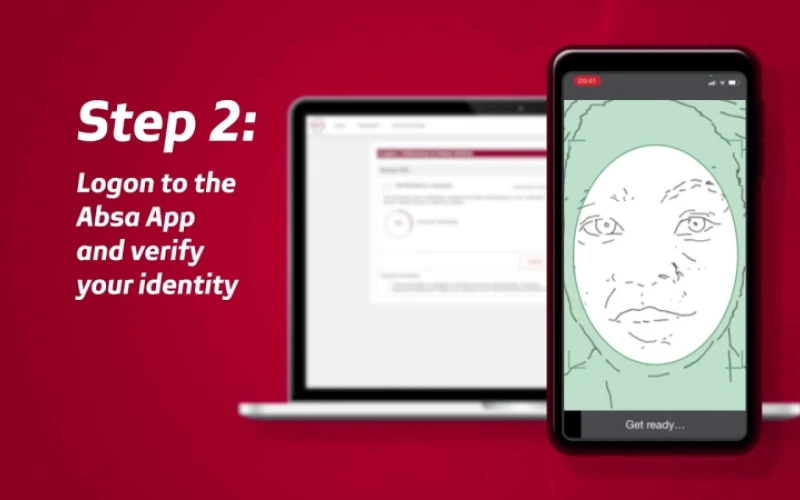

2. Can I open a Capitec account online?

Yes, opening a Capitec account online is simple and quick. With the Capitec mobile application, you can open a savings or transaction account without visiting a branch. Simply download the app, scan your ID, and complete the registration process. Online account opening saves time and offers a hassle-free banking experience.

3. How much do Capitec tellers earn?

Capitec tellers earn competitive salaries, typically ranging between R8,000 and R15,000 per month, depending on their experience and location. Capitec also provides growth opportunities for employees, making it a desirable workplace for those pursuing a career in banking.

4. How much must I earn to qualify for a Capitec loan?

To qualify for a Capitec loan, you must earn a minimum of R3,500 per month. Loan eligibility is determined by your credit history and affordability assessment, ensuring that you can manage repayments comfortably. Use the Capitec mobile application to calculate your loan affordability and apply seamlessly.

-66f6cf70ee785.webp)

-669a65418c179.webp)

-66952975d08f6.webp)

-66913619135f2.webp)

-668684d3dc155.webp)